Experian Opt-Out

Table of Contents

Managing your privacy with credit reporting companies like Experian is essential to avoid unwanted marketing and data sharing. Opting out helps protect your personal information, reduces spam, and minimizes the risk of data misuse. Consider the implications of remaining opted-in, such as increased exposure to targeted advertisements and potential privacy concerns.

What is Experian?

Experian is a credit monitoring company. They assist consumers in making informed financial choices while planning comfortably. Like other reporting sites, consumers can find their credit score estimates using Experian's internal tools. To do this, the consumer must first "sign up". Within this process, the consumer agrees to allow Experian to share their data and market to them; to stop the marketing, the consumer will need to "opt out" of Experian's offers, advertisements, and communications.

How Can I Remove Myself/My Name From Experian

This guide uses email and in-browser forms to complete all the necessary steps, and links are provided where available. Experian's privacy policy is broken into specific approaches; instead of having one method to opt out of everything, there are multiple methods to opt out of targeted areas.

Where to Start Your Experian Opt-Out

Unlike most other credit companies, Experian offers several options for opting out of their services. While this is good for consumer transparency, interaction fatigue is also risky. Such fatigue occurs when the consumer becomes frustrated, confused, overwhelmed, or tired after attempting unfamiliar processes. Often, this results in the consumer abandoning their venture, in the case of Experian, this means continued communications.

Experian's privacy policy offers several links in their opt-out section, all redirectors to other pages within the website. Despite the number of links above, there are only three procedures the consumer must complete. The first four topics (direct mail, telemarketing, email, and online targeted advertising) can complete simultaneously with the right information.

Note: This guide does not speak about Tapad, which requires your Mobile Advertising ID (MAID), your electronic serial number. Find this number on the back of your device, on the device's battery, or by looking around internal system files.

How to Opt-Out of Experian: Step-by-Step

Opting out of Experian's communications and data-sharing practices involves a few specific steps. This section will guide you through the process, ensuring that your privacy is protected and your preferences are respected. The opt-out process is divided into three main categories: direct mailing lists, telemarketing services, and targeted online advertisements. Each category requires different actions, but this guide will help you navigate each one smoothly. By following the instructions provided, you can minimize unwanted communications and safeguard your personal information.

Step 1: Opting-Out of Experian's Direct Mailing Lists, Telemarketing Services, Email Communications, and Targeted Online Advertisements

Experian has tricky opt-out methods for the communications above. Each topic has its privacy page on Experian's website and specific requirements for fulfillment. The consumer has three ways to disclose their opt-out:

- Call Experian customer support at 1-833-210-4615 for account assistance.

- Physically mail the offices at Experian/PO Box 703/Allen, TX 75013.

- Email all the information to the necessary parties.

For this guide, the following information is written regarding emails. This method is streamlined to provide everything required by every department/policy for a successful, total opt out. However, if the consumer wanted to mail Experian, they could copy the resultant email into a text application and print it out. Just sign your name and date at the bottom (plus keep a copy of everything you send).

Note: Opting out of Experian's influence will mark your information as "Do Not Target" for five years. After this, offers and communications will automatically begin again. Further, communications may restart if you move or change your name.

Experian's direct mailing lists, telemarketing services, and targeted online advertisements have similar requirements. To fulfill the requirements for these three opt-outs, the consumer will need the following information:

- Full name and name variations

- Physical mailing address

- Email addresses

- Telephone number (plus area code)

All this information will go to optout@experian.com. We'll also send it to Experian's email database departments at unsubscribe@experian.com and unsubscibeall@experian.com; below is an example of an opt-out email that qualifies for a successful process. Copy and paste the text into an email draft, then exchange the highlighted elements for your information:

Send to Emails: optout@experian.com, unsubscribe@experian.com, unsubscribeall@experian.com

Subject: Opt-Out and Unsubscribe Requests

Mail Body:

Hello,

I am opting out of all communications with Experian. Please mark my information with "Do Not Mail" and "Do Not Online Target" for five years. I want to be removed from all Experian direct mailing lists, telemarketing lists, and online targeted advertising.

Additionally,please remove me from Experian's influence as a marketer and email database:

- Unsubscribe me from all Experian email marketing.

- Unsubscribe me from Experian's email database.

Consumer Information:

- [Full name and any known variations]

- [Property or mailing addresses]

- [Infected or fresh telephone numbers, including area codes]

- [Email addresses associated with your accounts; unsubscribing will happen to the account you send the email from]

Please contact me if you need other information or encounter a problem.

Thank you,

[Full name]

Step 2: Opting-Out of Experian's Partners and Programs

Next, we'll focus on opting out of Experian's partners and relative programs. The privacy policy regarding partner opt-outs (below) argues that consumers are actively limiting their purchasing power by opting out. At the same time, it also relieves a potential torrent of targeted advertising.

To opt out of Experian's Partner Programs, head to their privacy page and select the hyperlink that reads "Click here".

Immediately, the page will refresh to https://optout.aboutads.info/ (below); this is a consumer choice tool. Within this form, internet users can alter the ads they see based on the company providing the ad. We will focus on Experian for this procedure, but users are welcome to opt out of all.

This ad suppression tool blocks adverts from opted-out companies; naturally, the changes only impact in-browser marketing. Some screens may open and close as the tool verifies your browser's suppression abilities. Allow the process to complete; a pop-up will bring us to the next step.

The pop-up will read "Status Check Complete" and offer additional information about the choices that can be made using the tool. When ready, click "Continue" or the white "X" in the top right of the pop-up window.

The pop-up will close and display the tool dashboard. There is a long, scrollable list with companies on the left, their ad status within your browser, and a box for "opt out" on the right. Scroll down this list to find "Experian", then click the blue + to the left.

After selecting Experian, the + will become a -, and browser privacy rights will be displayed. Take note of the "Yes" status to the right of "Experian"; this will change if the process is successful. To continue the process, select the "opt out" check box on the right, it will turn dark blue, as shown. Then click "Submit Your Choices" at the bottom of the window.

Immediately, the page will refresh to begin processing the request. If only opting out of Experian, the process should be nearly instant. When finished, the website will give another pop-up; click on the "View Updated Results" button.

You'll be redirected to the tool dashboard; scroll down this list to find Experian again. If the process is successful, the statuses to the right will read "Opt-Out Completed" and a gray, embedded check mark.

Step 3: Opting-Out of Experian's Prescreened, Firm Offers

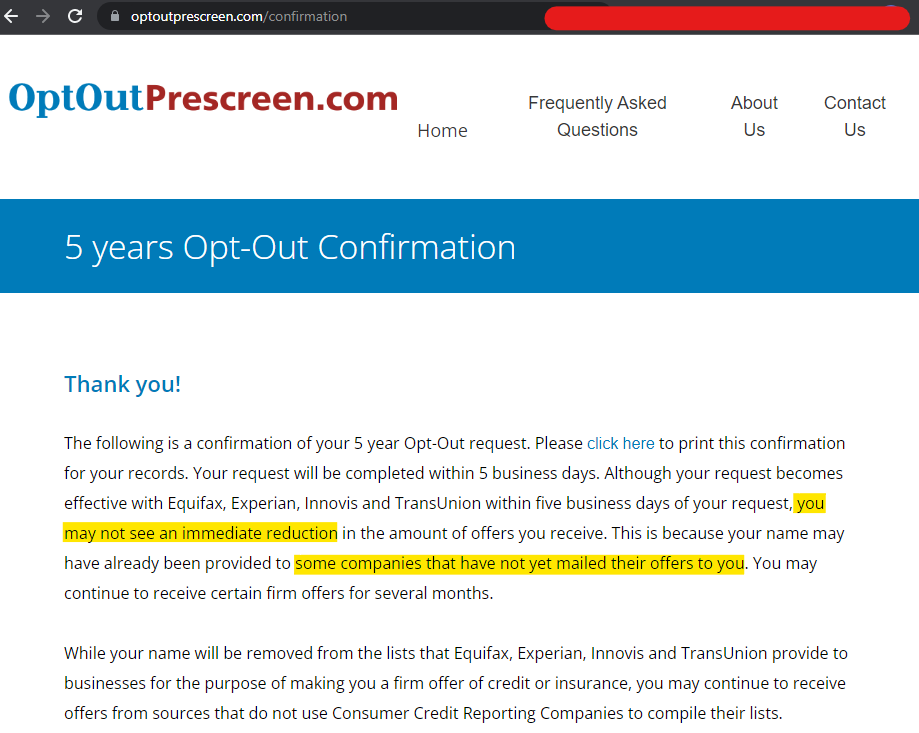

Experian is one of the biggest credit reporting companies; subsequently, they follow the industry standard for opting-out procedures. Experian follows the process laid out by OptOutPrescreen.com to monitor and manage firm offer opt-outs. "Firm offers" are curated opportunities sent by lender corporations like banks or insurance. These offers beat the rates of public-access deals at any given time; unfortunately, they also become annoying spam.

Head over to Opt Out Prescreen and scroll to the bottom of the page. Click the button that says, "Click Here to Opt-In or Opt-Out".

A new page will populate entitled "Opt-In or Opt-Out", along with an explanation of the process moving forward. There are two important things to note about the information here; (1) the form has a limited 15-minute time limit; (2) consumers don't necessarily have to enter their personal information like Social Security Number and birthday. When ready, scroll to the bottom of this page and select "Electronic Opt-Out for Five Years", then "Continue".

The next page will be the "Electronic Opt-Out for Five Years" form. Fill in the information as requested; note that only the topics with an * are necessary. At the bottom of the page, type in the CAPTCHA and click on "Confirm".

The next web page that populates is the "Five Year Opt-Out Confirmation" page; an explanation explains that consumers may not see an immediate decline in their opt-outs due to mailing lists.

Note: OptOutPrescreen.com also offers a permanent opt-out option. To complete this process, the consumer must navigate back to the selection screen, select the option, fill out the form, print out the resulting letter, fill it out, then physically mail the letter to:

Opt-Out Department

PO Box 530200

Atlanta, GA 30353.

Set an Alarm to Come Back and Verify the Changes

Almost anyone can remove information from Experian; getting rid of all the connections will take some time, and impacts may take longer to feel. Set an alarm or reminder for six months from when you receive confirmations. If the content hasn't dwindled, it's time to call customer service.